In speaking to my friends, I hear similar stories of how they did not do enough when they were young, and now regret making wrong choices, or not taking decisions on time. For example, a dad of college going student just told me if he had started real estate investment when he first learned about it, he would be a millionaire by now. Another couple, having a $250k in cash in their bank account, is concerned why they didn’t invest that cash when the time was right?These are just two of many stories I hear every day. If only I could go back in the past to help myself, and help others. But, if you are one of 20-30-40 year old who is looking for answers, may be this would help.

Today, I am sharing something that I have learned from my personal experiences; and the experiences of my close friends, family members and acquaintances. This is my take on how to create a financially free life. Some of this information, I have read and learned from various books and other sources. A lot of information here is going to help you in your life whether you are 20 years old, or 40+. It does not matter where are you in your life when it comes to Financial Education – this could be either a fresh perspective at things, or a refresher for you if you already know. And if neither of those, It could be a way for you to know where I am at fault, and share your thoughts and advise to others, including I, can benefit.

Where are you?

Table of Contents

First off, let’s start with where are you in your life. Are you a 20 something, just starting out in your first job or still in college planning to start your own startup? Or, you are in your 30s, starting a family and looking for that next promotion? May be you are past all that, in your 40s and juggling between kid’s school, office and swimming classes. It doesn’t matter. This information will help you get started wherever you are in your life. What is required though, is to “know thyself”. You must take a stack of yourself and then decide on the plan and next steps for financial freedom. Why? Let’s discuss.

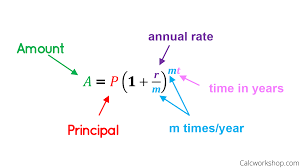

The first and foremost thing in life that you can not control, is Time. You can control money, relationship, and many other things – but time is not in your hand. Now, when it comes to financial freedom, you need two levers to work for you – Money and Time. Financial Freedom comes from a feeling of security that you do not need to worry about money, when you need it. In order to have that kind of financial stability, you need to use the power of compounding interest. And the formula of compounding interest is driven by money and time.

If you have an “amount” in mind, the more money you have, the less time you need for the compound interest to generate that amount. But, if you understand the math, if you have less money, you need more time. Or, to put it simply, if you start early in life, with small amounts of money, over time, it can become a substantial asset for you. Here are a few examples:

The Power of Compound Interest

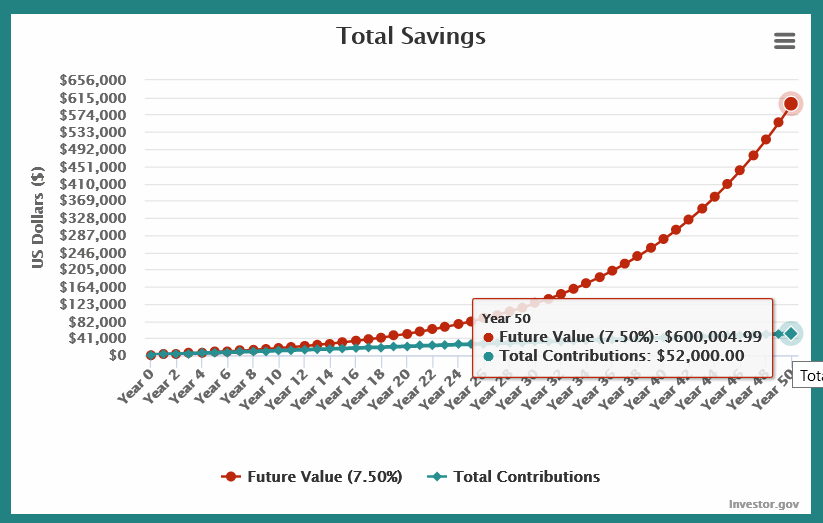

Lets start at age 20, and you save $5 every week day. That will be $1000 after 200 days, or approximately a year (200 working days). You invest this money and do not touch it – let it grow at a compound interest rate of 7.2% – it will be worth $32000 by the time you reach 70 years. We did not add anything to it – just $1000 left alone to grow for 50 years. Now, If you had waited and started this when you were 30, it will be only worth $16,000. On the other hand, if you had added another $1000 every year to that investment, it will be worth over $600,000 after 50 years. Imagine the power of compounding.

Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

So whats the moral of the story – Start Early, save a little, add it to your investment, and let it grow over time. That is the simplest formula to Financial Freedom.

How do I do it?

Getting your life on track for Financial Freedom is easy. It just needs some commitment and discipline.

It’s an easy 5 steps formula.

- Know Yourself

- Pay Yourself First

- Automate your Savings and investments

- Build Wealth

- Secure your Future!

First step, is to know yourself.

It includes knowing your financial goals, and your financial weaknesses. What are your financial goals? where do you see yourself 5-10-20 years from now. When do you want to be financially free?

In order to know yourself, find out your spending habits – things that are taking money from you and giving it to causes that do not align with your future goals of financial freedom. Example could be a subscription service that you rarely use and pay $15 per month; A Starbucks Frapuccino that you can live without, but still pay $4 every day. These are the expenses you can stop and turn into automated investments. Track your expenses for 1 week, and you’ll see how much difference can it make! Unless you measure it, you can not manage it!

Once you find where are you spending your money and you can then start saving enough to start your investment journey. And, this investment doesn’t need to be tens or hundreds or thousands of dollars. You can start as low as $5 a day – that equates to $150 a month and over $1000 a year. The key is discipline.

Remember: The more you can save, more you can invest.

Step 2 is to Pay Yourself First

It’s a cliche, and used pretty much anywhere investment advise if provided, but many people don’t understand what it means. From your paycheck, take aside a set percentage first – for your future self – before you start paying your bills and spending money on other expenses. The easiest way to do this is to use your retirement savings options such as 401(k), IRA/Roth IRA etc. provided by your employer. If you are able to use the maximum benefits of 401(k), that will be adding close to $19000 per year to your retirement account. This can translate into million dollar portfolio depending on your age, and ongoing addition to this account.

Find out what retirement account options and benefits does your employer provide. Some employers match 401(k) contribution amount from anywhere between 1 to 6%. That is additional income – or FREE money – for you. Moreover, 401(k), and IRA investments, are Pre-tax deductions which means you’ll also save taxes on this money. Thats like saving money on top of Free Money! It may seems a small amount, but let it grow untouched and soon you’ll see how fast it can grow. One other important factor to consider where you invest the money using your 401(k). This may take some knowledge of various funds and options available with your 401(k) provider – more on this later.

So, from this month – Pay Your (future) self First, before you spend money on your (current) self now!

Step 3, Automate your savings and Investments

Next steps after increasing your savings is to automate your investments. You can choose it using your broker, or using any of the automated platforms. There are apps like Stash, that can help you automatically invest and you can use my referral link to get $20 in free money to get started and help you stay on automated saving/investing discipline. Automating your investment using a Systematic Investment Plan (SIP) can help fill your investment basket slowly, and steadily. It helps to keep this automatic, on a regular schedule to that whether the market is up or down, you’ll not lose the momentum and enjoy dollar-cost-averaging as you add assets to your portfolio. When choosing the asset or vehicles to us SIP, if you do not have time or knowledge to research the options, just select an index fund. More on this later. You can also find other ways to invest as I shared some time ago – where should I Invest my money?

Step 4, Building Wealth

Once you have started paying yourself first, and have a good handle on your expenses and savings – you can start looking at options to build your wealth. Stock market (equities) are certainly one of the ways and we already covered that in step3 to automate that. Now, is the time to look at other wealth building options – Real Estate or REITs, Precious Metals, Cryptocurrencies, Small Businesses and more. We will continue to talk about these options in future posts.

Step 5, Secure Your Future

Last, but not the least, one of the important things to consider is to secure your future. With your nest egg set on automation, it will continue to grow. You will continue to work to add more to that nest egg. As you grow in age, and your family grows, there are risks that could impact the security of your nest egg. Things like a Pandemic, someone eyeing your property and suing you, a medical emergency, an unfortunate accident – anything could impact your nest egg for short term or long term. In order to have the security, add Insurance to your financial plan. It doesn’t need to be a fancy whole life insurance that takes away a lot from you and return a little. It can be a term life insurance, that is just a few dollars a day and provide you the peace of mind. Also, plan on having a Will, a Trust (if you have a substantial asset to protect).

I will continue to talk about these things in coming posts on this blog, but I hope that this will get you started. Remember, the most important aspect of generating wealth, or anything worth having for that matter – is to take Action! If you have read this post, thought about what you are going to do, the next obvious step is to take action. Go ahead, do it, and share your learnings with everyone here.

I hope this was helpful, and wish you a life of financial freedom!